Les 4 atouts pour votre patrimoine

-

Conseil en stratégie

Conseil en stratégie

patrimoniale -

Conseils

Conseils

en investissements -

Stratégie patrimoniale

Stratégie patrimoniale

pour l’entreprise -

Suivi

Suivi

personnalisé

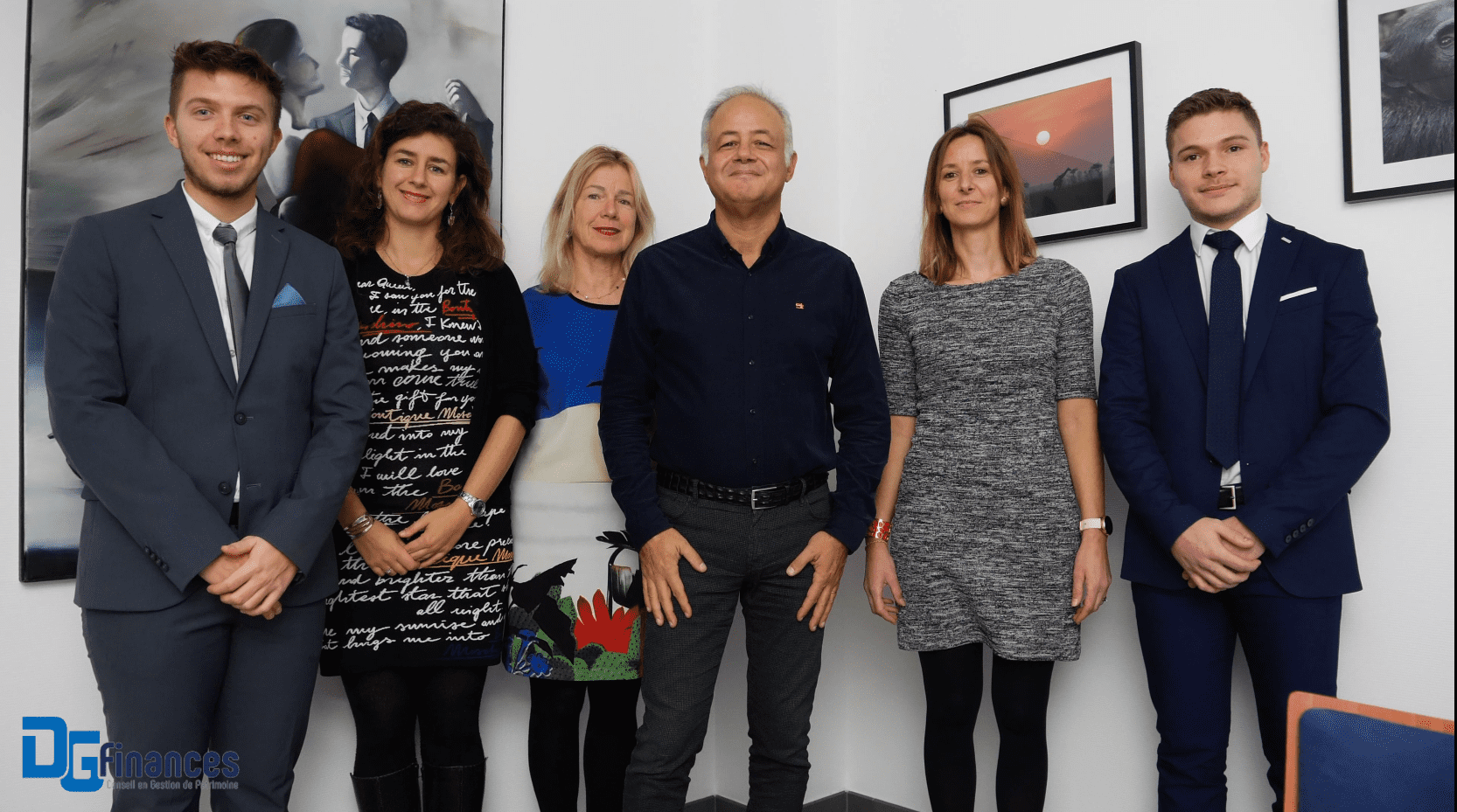

L’expertise DG Finances

Expert en gestion de patrimoine, DG Finances est un cabinet de conseil en matière d’optimisation de votre patrimoine. Patrimoines, placements, performances économiques, … au fil des années le cabinet DG Finances s’est doté d’un réseau de partenaires tels que notaires, experts-comptables et avocats afin de répondre avec précision et sur mesure à vos interrogations. Fort de 4 conseillers experts, DG Finances est votre partenaire de conseil et gestion de patrimoine dans l’Est de la France, sur toute la Lorraine et les territoires mitoyens. DG Finances exerce son activité de COA au Luxembourg et en Belgique au titre de la LPS. DG Finances accompagne également des ressortissants européens résidant en France.